A record-setting year in 2020 for retail sales, direct sellers, and customers had the US direct selling channel riding high and carrying tremendous momentum into last year. Although 2021 sales are expected to return to historical norms—the USDSA will release final figures in June—during the pandemic, the channel emphasized the impact of its presence on local economies, showed investors the adaptability of its business model, offered displaced workers clear paths for career options, and gave consumers a diversity of products for living in a post-COVID world.

Gen Z and Millennials are among those with a growing interest in the channel who see the positive opportunities of having direct selling in their lives. This is good news for the future of direct selling. And with the next few years likely to bring more disruption, consumer attitudes and behaviors will likely change as well. In addition to the lingering impacts of the pandemic, ongoing challenges from e-commerce platforms and increased competition for workers by other industries, direct selling will need to closely monitor consumer and worker sentiment to stay competitive and remain relevant.

A Changing Environment

The channel’s success in 2020 took many by surprise. The United States was deep into a pandemic that led to the loss of millions of American jobs and a sharp decline in consumer spending. Yet direct selling achieved double-digit growth, not only in retail sales but also in the number of direct sellers participating in the channel and the number of preferred customers and discount buyers.

Direct sales broke the $40 billion mark that year, with the channel generating $40.1 billion, up 13.9 percent from 2019. By comparison, in the last decade, the greatest percentage increase was 2012’s high of 5.9 percent.

The number of people using the model to sell products or services broke records—with 7.7 million, a 13.2 percent over 2019, and with 41.6 million preferred customers and discount buyers, a 12.7 percent increase over the prior year.

Those numbers helped to strengthen the long-held perception that the channel excels during the toughest economic downturns. As DSA President and CEO Joseph N. Mariano noted upon the release of the data, “Direct sellers prove time and again to be nimble microentrepreneurs, willing and able to serve their customers and communities within a changing environment.”

This past October, DSA released its forecast for 2021 based on its own research, public company reporting, member growth expectations, and broader retail and labor market macroeconomic indicators. The Association expects to see a sales increase of 4 to 7 percent—a range between $41.7 billion to $42.9 billion—which would be in line with, or slightly exceed, industry percentage increases of the last decade.

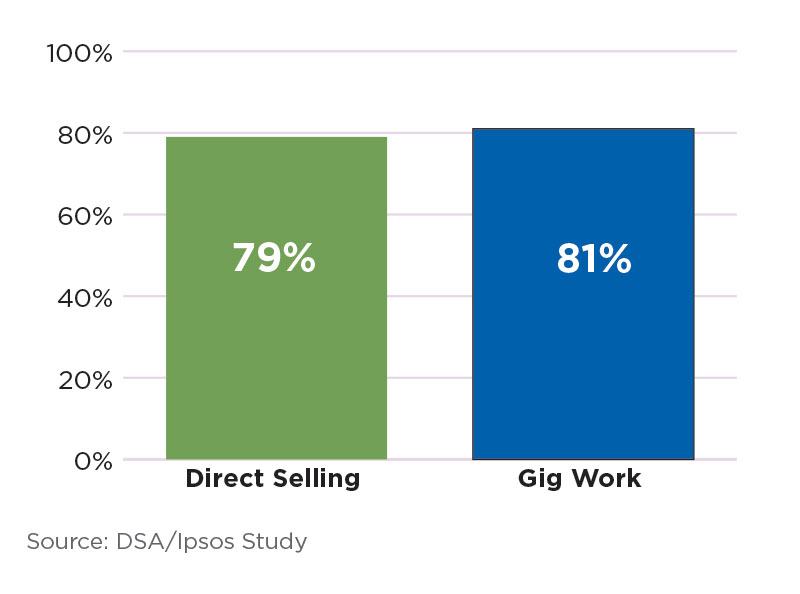

Direct selling is seen as an attractive option for entrepreneurial opportunities. Favorability toward…

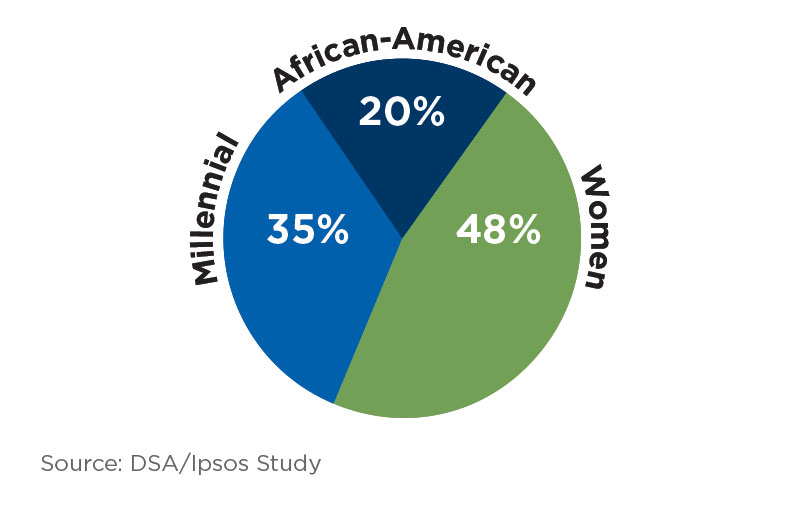

Direct selling has broad, diverse appeal in the United States. Direct selling prospects are:

About 80 percent of US consumers exhibit positive perceptions of direct selling, a figure that has remained stable for more than a decade. Consumers find the following most appealing about the direct selling channel:

Entrepreneur Attitudes

Every three to five years, DSA publishes its Consumer Attitudes & Entrepreneurship Study, a comprehensive report designed to help direct selling leaders better understand consumer attitudes and perceptions about the channel. In late 2019, DSA commissioned Ipsos, the third-largest market research firm in the world, to conduct a new study, the results of which were released in March 2020.

The report revealed that 77 percent of Americans are interested in flexible, entrepreneurial opportunities, with 91 percent of Gen Z and 88 percent of Millennials showing an interest in direct selling. Interest in starting an entrepreneurial opportunity was relatively equal among men (79 percent) and women (76 percent).

Given the data supporting Americans’ interest in entrepreneurship, Ipsos noted that while US unemployment is near a fifty-year low, average wages have been stagnant for the past fifty years, and household debt has increased. Americans are looking for options to earn supplemental income to improve their sense of financial security during these challenging times.

What do people want from their entrepreneurial opportunities? An October 2021 DSA survey found that they want the following:

-

Trustworthiness of company (52%)

-

Low start-up cost (48%)

-

Low risk (47%)

-

Ability to work from home (46%)

An Ipsos September 2021 survey found work–life balance (58 percent) and flexible work hours (56 percent) to be among the top reasons that Americans stayed at their jobs. Other top reasons included a positive work environment/culture (44 percent) and competitive pay (40 percent).

Consumer Attitudes

Consumer attitudes have evolved over the course of the pandemic. COVID and its aftereffects convinced buyers to rethink how they buy, when they buy, and why they buy. Another post-COVID shift in consumer thinking is an increased focus on shopping local. Many consumers, especially those who witnessed the struggles of neighborhood businesses, changed their shopping habits at big-box retailers to support the small, local shops that were hit hard by the pandemic.

Direct selling is having its moment as the buy local mentality extends to purchasing from the channel’s independent business owners. The buy-local shift comes just as consumers are having increasingly positive attitudes about direct selling.

According to the DSA/Ipsos study, consumers give positive reviews to their direct selling experiences and have a positive perception of direct selling as both an attractive entrepreneurial opportunity and as “an ideally personalized and convenient way to shop local.”

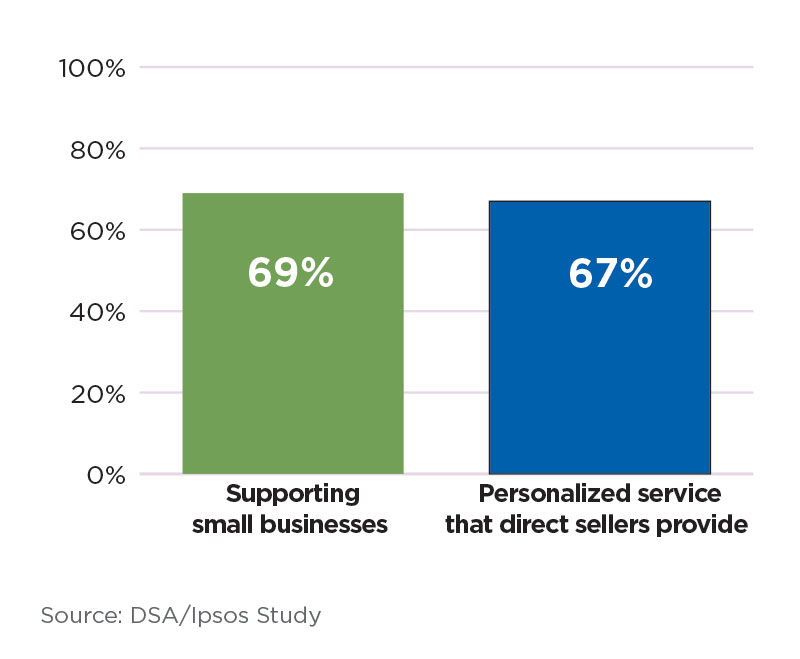

The survey noted that this sentiment toward direct selling is not new. Over the last ten years, the perception of the channel has remained at about 80 percent positive. Also, most consumers feel good about and find value in supporting a small business (69 percent) as well as the personalized service that direct sellers provide (67 percent).

In addition, the study revealed a growing shift to purchasing online from direct sellers, with almost half (46 percent) of those participating in the survey willing to welcome contact from direct sellers regarding business opportunities on social media.

Will these good feelings about direct selling continue? There’s reason to believe they should, especially when considering the recent mindset of consumers. Consider this: consumer sentiment during the pandemic reached its lowest point in April 2020 (45.1 percent) and its highest point (62.4 percent) in June 2021, according to the Ipsos Forbes Advisor Consumer Confidence Tracker. Shortly thereafter, it fell again as the Delta variant of coronavirus appeared. Yet, through it all, interest in direct selling products and opportunities climbed to an all-time high, evidenced by record-setting sales and nearly one million people choosing direct selling over other forms of gig work in 2020.

Looking Ahead

Direct selling had a successful decade from 2010 to 2019 compared with its retail sales counterpart. The channel started the decade with six consecutive years of sales growth, topped by an all-time high of $36.12 billion in 2015. While 2020 will be bookmarked as a year in which sales results exceeded all expectations, the public’s opinion of direct selling for the way the channel adapted to a rapidly changing and disruptive world may be its greatest achievement of the year.

On the entrepreneurial front, displaced workers seeking financial security found direct selling opportunities compelling and a promising alternative to gig work. Women, who were disproportionately affected by mass layoffs, found the flexibility they needed to care for their children while embarking on new careers. Younger people wanting to start their own businesses and take control of their financial destinies found opportunities in the diversity of products and services offered by our companies.

On the consumer front, COVID put a greater focus on health. People who wanted help making lifestyle changes found products and guidance for healthier living through direct selling’s health and wellness companies. Simple pleasures, such as cooking together or reading to children, spoke to consumers shuttered in and looking for opportunities to return to the fundamentals of a good life.

As the next few years see more changes, direct selling is well-positioned for continued success. Attitude is everything in a crowded marketplace. The channel’s ability to innovate and adapt has proven to entrepreneurs and consumers that it will continue to be a winning business model well into the future.

Direct Selling 2010-2019

2010: increase of 0.6% to $28.5 billion

2011: increase of 4.8% to $29.87 billion

2012: increase of 5.9% to $31.6 billion

2013: increase of 3.3% to $32.7 billion

2014: increase of 5.5% to $34.47 billion

2015: increase of 4.8% to $36.12 billion

2016: decrease of 1.6% to $35.54 billion

2017: decrease of 1.8% to $34.9 billion

2018: increase of 1.3% to $35.4 billion

2019: decrease of 0.5% to $35.2 billion

2020: increase of 13.9% to $40.1 billion

What Entrepreneurs Are Saying about Their Direct Selling Opportunities

Direct selling is more than just a business opportunity. For many, they are brand ambassadors sharing the products they love—those that help them look and feel better, take control of their health, offer supplemental education to their children, or just bring happiness into the lives of their families and friends. Others look to direct selling for the supportive communities, friendships, and networking. Here is just a sampling of the ways direct selling has impacted the lives of entrepreneurs.

Traveling Vineyard

“I love marketing a consumable product that appeals to all demographics. We have something for everyone and at an affordable cost.”

—Carla, Traveling Vineyard

Rodan + Fields

“Recently, someone asked, ‘What anti-aging skin care do you use? Your skin looks amazing.’ I was excited to get the compliment and help her get the Rodan + Fields products that I use.”—Tanya, Rodan + Fields

SimplyFun

“I’ve been a SimplyFun Independent Playologist for almost seven years. I bring families together and help kids learn through PLAY with SimplyFun’s family and educational board games. I absolutely love getting to set my own hours.” —Mary, SimplyFun

Zurvita

“Zurvita gave me a new life, restored health, a transformed mind, and a stronger body at 56 than at 36.” —Theresa, Zurvita

Jordan Essentials

“I love Jordan Essentials products! It’s a big plus that I can trust that they are safe for my loved ones and me, and I can say that with confidence to my customers for their families.”—Jennifer, Jordan Essentials

Omnilife

“I started with Omnilife to improve my life. I lost ten pounds by gaining a business that has me eating a healthy diet, implementing my physical activity plan, and having proper rest.”—Rosa, Omnilife